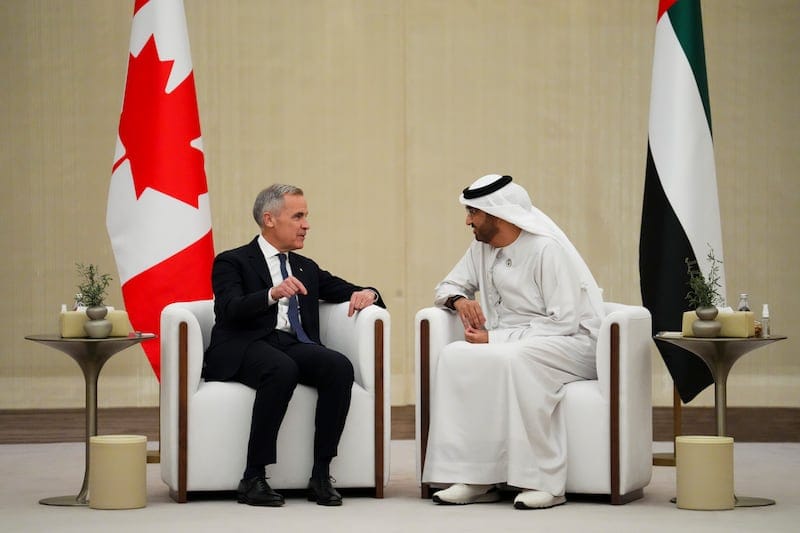

Canada has stepped into a new phase of economic diplomacy. During his visit to Abu Dhabi, Prime Minister Mark Carney signed an investment-protection agreement with the United Arab Emirates and launched talks toward a comprehensive trade deal. This shift signals a broader opportunity for Canadian staffing and talent strategy professionals to anticipate labour market effects beyond traditional sectors.

The agreement establishes a foundation of investment security between Canada and the UAE, making foreign investment flows more predictable and anchored by formal protections. It also opens the door to a wider trade relationship that could reduce tariff barriers, fuel cross-border venture activity, and accelerate investment in sectors such as artificial intelligence, data centres and advanced infrastructure.

For the staffing community the key question is what this means for talent pipelines, regional demand and business lines. First, higher levels of UAE investment in Canada tend to favour areas where capital meets capacity: technology platforms, data centre operations, energy-oriented infrastructure and managed services. The UAE has already shown interest in powering global data hubs and leveraging affordable energy for digital platforms, a model that Canadian regions with strong grid capacity or renewables could mirror.

Second, the agreement implies a demand shift toward globally-oriented skills and international staffing models. Canadian firms may receive capital from UAE sovereign wealth funds, enter joint-ventures or build satellite operations. That will place pressure on staffing firms and internal recruiters to source bilingual or globally mobile talent, to design wage and mobility frameworks aligned with international investment, and to craft onboarding strategies that anticipate cross-border flows and integration.

Third, the regional lens matters. Provinces already oriented toward innovation and international investment such as Ontario and Québec are likely to attract the lion’s share of activity. Montréal’s tech and data centre ecosystem, Toronto’s fintech networks and Ontario’s industrial hubs may become landing pads for UAE-backed projects. Staffing firms in these jurisdictions should start building candidate pools for roles such as data centre engineers, cloud infrastructure technicians, cybersecurity specialists and international project-managers. At the same time, smaller jurisdictions could win roles tied to supply-chain, logistics or maintenance if investment selects remote-friendly or energy-rich locations.

From a workforce planning standpoint the ripple effects may be less dramatic than a full manufacturing programme. Nonetheless they are meaningful. Staffing firms should monitor the types of sectors likely to scale: digital infrastructure operations, asset-management services, renewable energy links to data-hubs, cross-border desk and project operations roles. Internal talent planners at large employers should consider how investment from regions with high-capital intensity (for example the Middle East) differs from more traditional FDI (foreign direct investment) from Europe or the US in terms of speed, mobility demand, expatriate components, and project-based roles.

This post is for paying subscribers only

Subscribe now and have access to all our stories, enjoy exclusive content and stay up to date with constant updates.

Already a member? Sign in