The industrial labour market is not collapsing. It’s reorganizing.

The last month of job posting data across key blue-collar and technical roles shows a market that is shifting away from pure expansion and moving toward resilience. Some categories are cooling, some are stabilizing, and some are quietly surging. Demand is still there, but it’s no longer in the same places as 2022–2023.

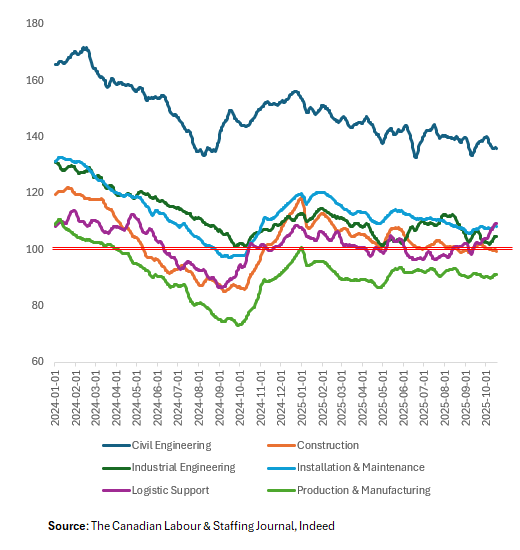

Job posting volume per category (100 = pre-Covid level)

Civil engineering

Civil engineering is still running hot. Hiring in civil engineering remains close to 40% above pre-COVID levels. That level of sustained demand is rare this late in the cycle and it isn’t drifting down. This is being driven by long-horizon work that doesn’t turn on and off with a quarter’s GDP number: public infrastructure, utilities, energy transition projects, climate resilience upgrades, transit, water systems, and grid modernization. Governments and large infrastructure owners are still spending, and those projects keep needing talent. This part of the market is behaving like a protected zone. It doesn’t look cyclical; it looks structural.

Construction

On the other hand, Construction has found a floor. Over the summer, construction job postings slid below “normal,” which would normally be a red flag for the broader economy. But in the past few weeks, the trend has stabilized and crept back toward pre-COVID baseline. This isn’t a return to boom conditions. It’s not speculative commercial building. What we’re seeing instead is a shift in the mix: work tied to public pressure to build housing, repair and expand physical infrastructure, and deliver politically urgent projects. That kind of work doesn’t disappear just because interest rates are high. It suggests that large players with access to funding (and work connected to government priorities) are still hiring, while smaller private developers are not. For staffing agencies in the skilled trades, this is important. The storyline is no longer “construction has fallen off a cliff.” The storyline is “construction is now selective.”

Industrial engineering

Industrial engineering is cooling. A month ago, demand for industrial engineers sat a few points higher than it does today. That’s now slipping. These are roles tied to production efficiency, process optimization, continuous improvement, automation, plant layout, and cost control. When companies slow down hiring here, it’s usually not because they don’t care about efficiency. It’s because they’ve paused large-scale investment in new production capacity. That lines up with what’s happening in manufacturing: output is still there, but forward bets are getting smaller. Spending is getting defensive. There are fewer “let’s redesign the line for growth” projects and more “how do we squeeze more out of what’s already installed.” This is exactly what a late-cycle industrial economy looks like.

Production and manufacturing

Production and manufacturing hiring remains weak. Of all the categories tracked, core production roles are still the softest. Postings in production and manufacturing are running well below pre-COVID levels and have not meaningfully recovered. Employers are operating facilities, but they are doing it with leaner headcount and more automation. They are also cautious about adding general labour at scale when demand visibility is cloudy and trade exposure is high. For firms that built their book of business around “light industrial, high volume, fast fill,” this is the part of the market that has not come back to what it used to be.

And then there are two categories that tell a different story: installation & maintenance, and logistics support.

This post is for subscribers only

Subscribe now and have access to all our stories, enjoy exclusive content and stay up to date with constant updates.

Already a member? Sign in